When Can I Retire With the Lifestyle I Want?

When can I retire with the lifestyle I want?

That’s the #1 priority for our clients—based on my experience creating thousands of financial plans over the last 25+ years.

They want financial freedom.

It’s what we all really want. But you need a retirement plan to get there. It won’t happen on its own.

Creating your retirement plan is fun. It’s not about the money. It’s all about your life.

Your retirement plan is the GPS for your life. It makes you wealthier, because it gets you to your goal the quickest and most effective way.

In my latest video, podcast episode, and blog post you’ll learn:

- What types of financial questions do people most ask about?

- Is it worth the effort to create your retirement plan?

- What insights from experience have I learned about financial freedom?

- Can your house be your retirement plan?

- What is the good news and bad news about retirement planning?

- How does your retirement plan make you wealthier?

- What are the steps to creating your Retirement Plan?

- How can you think through the retirement lifestyle you will want?

- How does interactive retirement planning help you make your plan personal?

- How should you invest effectively to become financially free?

What types of financial questions do people most ask about?

These are the kinds of questions I hear all the time:

- “I want to retire very young and very comfortably. How can I achieve that?” — Jonathan, age 29

- “What do I need to do to live freely and not think about money?” — Emma, 34

- “How can I stop worrying about my future and my kids’ futures?” — Christie, 43

- “We want to retire soon but don’t have enough yet. What should we do?” — Brian, 56

- “Will we have to work until we’re 75?” — Jennifer, 61

- “We’re about to retire. How can we maximize income and pay less tax?” — Nick, 63

These are smart, important questions—and the answers all start with a real plan.

8 Insights I’ve Learned Helping Canadians Become Financially Free

1. Becoming financially free is 100% worth it.

There’s a deep confidence people feel when I tell them, “You’re financially independent.” Life changes. Even if they choose to keep working, it’s on their terms. That’s the magic.

2. Sorry, but your house is not your retirement.

Over 90% of people want to stay in their home (or something similar) after retiring. So unless you plan to downsize dramatically, your home won’t fund your retirement. You need actual investments.

3. You need a much larger nest egg than you think.

Here’s the tough news: $1 million might sound like a lot, but at today’s rates, it provides about $35,000–$40,000/year before tax. If you’re retiring in 25 years, inflation cuts that in half—meaning just $20,000 in today’s dollars. That’s not much.

4. The good news: It’s easier to get there than you think.

Thanks to the magic of compounding, investing $1,000/month at 8% gives you $1.4 million in 30 years. If it’s in your RRSP, your real cost might only be $600/month after tax refunds. That’s do-able for many.

5. You need a plan. Full stop.

Most people I meet are on track to have just 20–30% of what they’ll need. A plan bridges that gap. It shows you how to get where you want to go.

6. You’ll probably need to invest mainly in equities.

If you want to retire with your current lifestyle, GICs won’t get you there. Equities (stocks) are the asset class with the highest long-term return. It’s very difficult—if not impossible—to retire well without them.

7. A retirement plan means you can stop worrying.

When you know your future is taken care of, life feels different. You can relax. You can live.

8. A retirement plan actually makes you richer.

It’s the GPS for your life. With a plan, you make better long-term decisions. You save more. You invest more effectively. Your wealth grows.

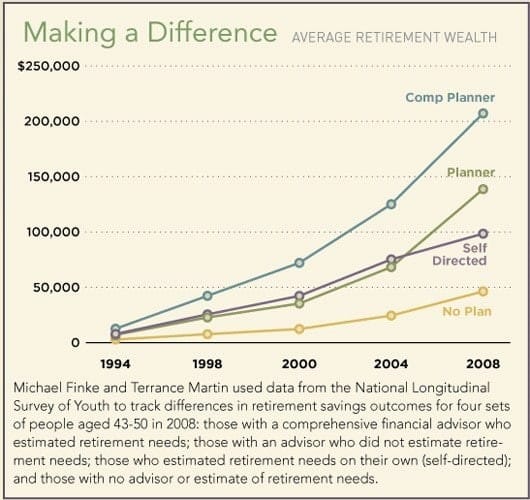

Want Proof? People With a Plan Have 4x More Wealth

A 15-year study looked at four groups:

- Do-it-yourselfers with no plan

- DIY-ers with a plan

- People who worked with an advisor (no plan)

- People who worked with an advisor and had a financial plan

The result?

People in group 4 had four times as much money as those in group 1. Why? A plan + professional support keeps you focused and helps you make better decisions.

The 4 Steps to Creating a Real Retirement Plan

Let’s walk through the process. (Spoiler: it’s simpler than you think.)

1. Define the Lifestyle You Want

Start with a list of your current spending. Then adjust it based on how you want to live in retirement. Calculate how much before-tax income you’d need to support that lifestyle.

2. Calculate Your “Magic Number”

That’s the total amount you need to retire.

- Adjust your income goal for inflation (for however many years until you retire).

- Subtract pension income (CPP, OAS, etc.).

- Multiply the remaining number by:

- 25 if you’re an equity investor

- 28 if you’re balanced

- 40 if you’re in GICs/bonds

- 25 if you’re an equity investor

That’s your magic number.

3. Figure Out What to Invest

Work backward to calculate how much you need to invest annually to hit your magic number. Use a reasonable rate of return and adjust for RRSP/TFSA tax benefits. Then ask yourself: Is this doable?

4. Make the Plan Work

If your first draft doesn’t work, tweak it:

- Adjust your retirement lifestyle

- Retire later or earlier

- Invest more or less

- Try an advanced strategy (e.g. Smith Manoeuvre, lifecycle investing)

Keep revising until you land on a version that works—and feels good.

This Is Called “Interactive Financial Planning”

You’re looking at multiple possible futures and comparing how to get there. When you find the one that’s both realistic and exciting, you’ve got your roadmap.

If you’re not sure your plan is optimal, work with a fee-for-service, planning-focused financial planner (like me). You should be able to create your full plan in one meeting, and walk away with a complete strategy—and peace of mind.

Final Thought: It’s Not About Your Money. It’s About Your Life.

Creating your retirement plan is fun. It’s life-changing. And it’s the foundation for a future where you’re in control.

So ask yourself: What do I really want from life—and how can I build a plan that gives me that freedom?

If you’re ready to stop worrying and start living, you know where to find me.

Let’s make it happen.

Ed

Planning With Ed

Ed Rempel has helped thousands of Canadians become financially secure. He is a fee-for-service financial planner, tax accountant, expert in many tax & investment strategies, and a popular and passionate blogger.

Ed has a unique understanding of how to be successful financially based on extensive real-life experience, having written nearly 1,000 comprehensive personal financial plans.

The “Planning with Ed” experience is about your life, not just money. Your Financial Plan is the GPS for your life.

Get your plan! Become financially secure and free to live the life you want.