Tax Strategies

Clawback Strategies

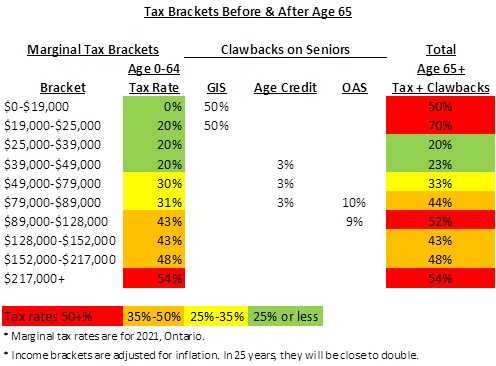

In Canada, government benefits are often paid only to those with lower incomes and then “clawed back” based on your income. Clawbacks are really additional income tax. Understanding clawbacks is a critical part of knowing whether to invest in RRSPs or TFSAs. The correct answer depends on your tax bracket while working compared to your…

Read MoreTFSA vs RRSP – Clawbacks & Income Tax on Seniors

“The future ain’t what it used to be.” – Yogi Berra Tax Free Savings Accounts (TFSA’s) were announced in the 2009 federal budget. At first, it seemed they would be not nearly as useful as RRSP’s since there would be no tax refunds for contributing. However, we are starting to analyze TFSA’s and it seems…

Read MoreTax-Free Savings Account (TFSA) – How should we use it?

The only reason I need these gloves is ’cause of my hands. – Yogi Berra 2009 brings one exciting new development – TFSAs. You may have seen a bunch of news coverage about them. We consider them to be the best new retirement savings vehicle since RRSPs. For many, perhaps most Canadians, they will be…

Read MoreTFSA vs. RRSP – Best Retirement Vehicle?

“You give 100 percent in the first half of the game, and if that isn’t enough, in the second half you give what’s left.” – Yogi Berra Tax Free Savings Accounts (TFSA’s) will be available in 2009. Should we be using them instead of RRSP’s to save for retirement? The short answer is that there…

Read MoreIs 100% Tax-Efficient Investing Possible?

One of the 3 D’s of tax savings is Defer. Paying tax some time far in the future is much better than paying tax now. One of the most effective ways of getting huge, compound growth in your portfolio is to pay as little tax as possible along the way. This is why RRSP investments…

Read MoreShould I Incorporate my Small Business?

This topic was requested by a reader and is a question I am often asked. The issues are all tax and legal, and can be intimidating. However, they can be summed up with a few questions. Read more…

Read More