How to Take Advantage of the Market After the Crash of 2008

“It’s never happened in the World Series history – and it hasn’t happened since.” – Yogi Berra

2008 was a difficult year, producing results not seen in recent history. In past bear markets, some sectors and significant groups of investors still made money. In 2008 only 4 of 3,438 equity mutual funds showed a profit.

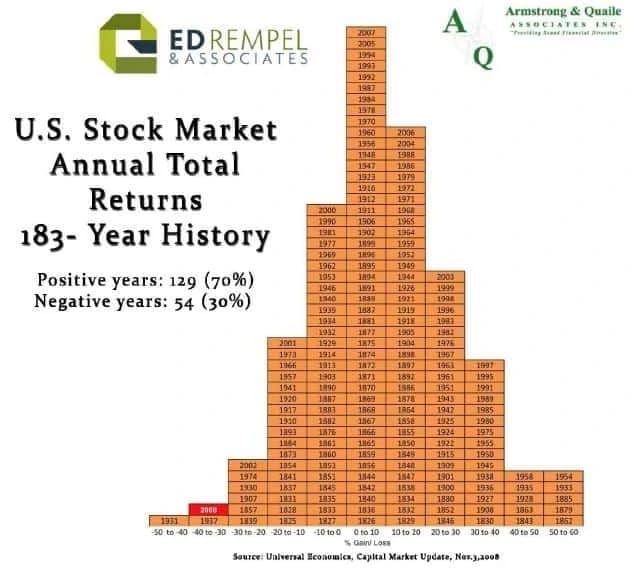

The attached chart with 183 years of market history puts a lot of things into perspective. It shows how many years the market returns were in each percentage range. By the time the year had ended 2008 found its place at the second column from the left at -37%.

What can we see from history?

1. 2008 was an extremely unusual year. It was not a typical bear market. The only years with losses that high were in the 1930s – The Great Depression. However, the problems we have today are minor compared to the 1930s, when unemployment was over 30% and the total production of the economy fell by 30%. It appears that governments have learned from their previous mistakes and are focused on bailouts and not making matters worse by cutting spending and raising taxes like they did in the 1930s.

2. Years with large losses tend to be followed by years with large gains, usually within 1-2 years. Note that only two years after 1931, great gains were made in 1933 (50-60% column), 1937 was followed by 1938 (30-40%), and most of the years with losses of 20-30% also had good gains within a couple of years.

3. Large gains are much more common than large losses. There are 25 years with gains over 30%, but only 3 with losses over 30%.

4. The markets do make money over time, including these bear markets. Note that 70% of all years are gains, large gains are much more common than large losses, and the most common returns are gains of 0-10% followed by 10-20%.

What should we do now?

1. Don’t panic. Stick with your long term goals. The markets have always recovered and gone to new highs. This is the most important time to stick to your plan. If you don’t have a financial plan, this is the best time to start one.

2. Disregard what is in the news. The recovery will not take 10 years. This is not the end of the world. While very unusual. It is not “different this time”. The panic is subsiding and companies will adjust their operations to become profitable again.

3. Don’t turn paper losses in actual losses. If you sell now or invest more conservatively, you will likely miss out on much of the inevitable recovery. If you want to invest more conservatively, wait until after a good recovery. Studies consistently show that trying to get out and time getting back in rarely works.

4. Buy low. Sell high. As Warren Buffett says “Be fearful when people are greedy and greedy when people are fearful.” Remain optimistic and focus on the inevitable recovery. I realize that it is difficult to be optimistic with all that is happening, but our fund managers are telling us they have never seen the market so cheap (even one who is 83 years old!). If you can ignore your emotions, and take advantage of it, this period will probably be the best buying opportunity of your life.

Bottom line: This is a huge buying opportunity!

Ed

Planning With Ed

Ed Rempel has helped thousands of Canadians become financially secure. He is a fee-for-service financial planner, tax accountant, expert in many tax & investment strategies, and a popular and passionate blogger.

Ed has a unique understanding of how to be successful financially based on extensive real-life experience, having written nearly 1,000 comprehensive personal financial plans.

The “Planning with Ed” experience is about your life, not just money. Your Financial Plan is the GPS for your life.

Get your plan! Become financially secure and free to live the life you want.