Random Walk Theory Debunked: The Best Market Gains Follow the Worst Crashes – And One Easy Rule to Beat the Market

Imagine checking your investments after a brutal market crash like during Covid with the March 16-20, 2020: -18% week. Your balance is down 32%, and panic sets in.

But what if I told you the biggest rebounds, like the +12% surge the very next week almost always follow?

This isn’t luck; it’s a pattern that makes stocks more predictable (and rewarding) than the ‘random walk’ myth suggests.

For the average investor saving for retirement, understanding this could mean thousands more in your pocket annually—without switching to boring bonds. Just change your outlook and use a simple method to beat the market.

In my latest blog post, video, and podcast episode you will learn:

- What is the “Random Walk Theory”?

- Why is the stock market not a “random walk”?

- How can you use this to your advantage?

- An easy way to beat the market.

What is the “Random Walk Theory”?

The Random Walk Theory is a financial theory that states stock prices move based on a random walk, meaning changes in prices are random, unpredictable, and independent of past movements.

It is like flipping a coin where today’s market price movement is unrelated to yesterday’s or tomorrow’s. Increases and decreases in value in any time period are purely random.

It is closely related to the Efficient Market Hypothesis (EMH) that states that stock prices fully reflect all available information at any given time, so the current price of every stock is the true value.

The key Idea of the 2 theories is that future price movements cannot be reliably predicted using historical data, patterns, or analysis because new information arrives randomly and is quickly incorporated into prices. This implies it’s impossible to consistently outperform the market through stock picking, timing, or technical/fundamental analysis—any success is due to luck, not skill.

If it was true, then:

- No investor or fund manager would outperform the index except by luck.

- Fundamental analysis would not work. It is analyzing a company’s financial statements, management, industry conditions, economic factors, and intrinsic value (e.g., earnings, revenue, assets) to determine if a stock is undervalued or overvalued.

- Technical analysis would not work. It is studying past market data, primarily price charts, volume, patterns, and indicators (e.g., moving averages), assuming that historical trends and investor psychology repeat.

- Market timing and stock picking would be futile.

- The current price of every stock is the true value even during market crashes and bubbles.

Why is the stock market not a “random walk”?

The “random walk theory” states that stock market results are purely random. They are like a coin flip and unaffected by any other results before or after. It’s like a drunk stumbling down the street.

For example, if you have a coin that just flipped heads 10 times in a row, the next flip is still a 50/50 chance of either heads or tails.

However, the stock market is not like that. With the stock market, big crashes are usually followed immediately by explosive rebounds. The largest losses and largest gains are usually right after each other.

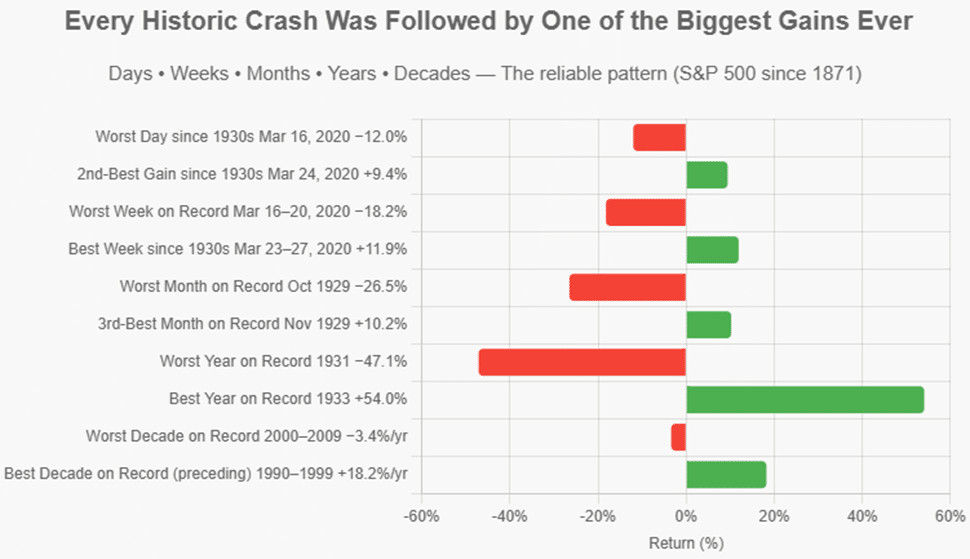

Here are the biggest gains & losses for a day, week, month, year and decade:

This means that the stock market is significantly more reliable than the random walk theory claims.

The stock market is also very irrational much of the time. Investors:

- Follow trends without logic (“herding”).

- Are often overconfident.

- Overreact to news.

- Become fixated on a specific past price such as their cost (“anchoring”).

- Have “loss aversion” that leads to holding losers too long and selling winners too soon.

- Drive the market into irrational crashes and bubbles.

All these irrational behaviours don’t fit with the efficient market theory that claims today’s stock price is the true value.

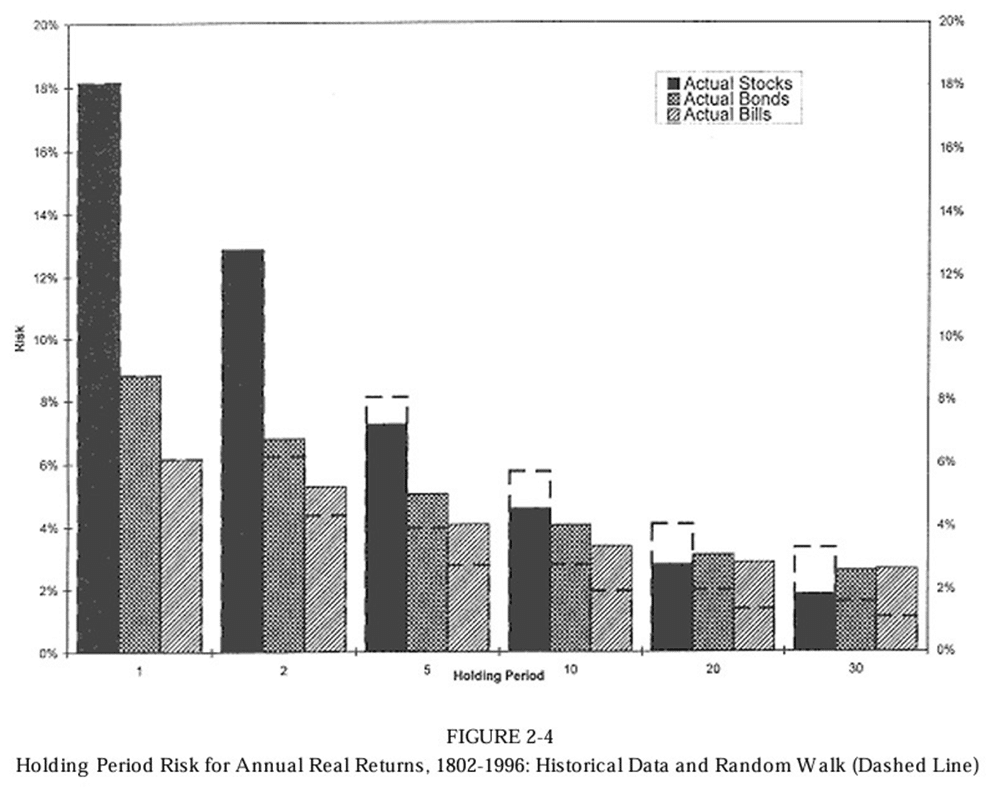

In his historic book “Stocks for the Long Run”, Prof. Jeremy Siegel proved that the Random Walk theory is not accurate for the stock market.

He showed the actual standard deviation (stat for unpredictability) of stocks, bonds & cash in real life and compared them to the random walk theory.

In this chart from his book, the dashed lines are the random walk. Note that stock market risk (unpredictability) declines much faster than random walk claims the longer you are invested. The actual standard deviation after 30 years is barely over half the random walk.

In contrast, the risk of bonds and cash declines much more slowly than the random walk the longer you are invested. For cash, the 30-year risk is more than double what the random walk predicts.

The reasons for this is that stock market big gains tend to be right after big losses.

However, bad periods of bonds and cash tend to be followed by more bad periods because they usually result from high inflation – which tends to stick around for a while when it appears.

How can you use this to your advantage?

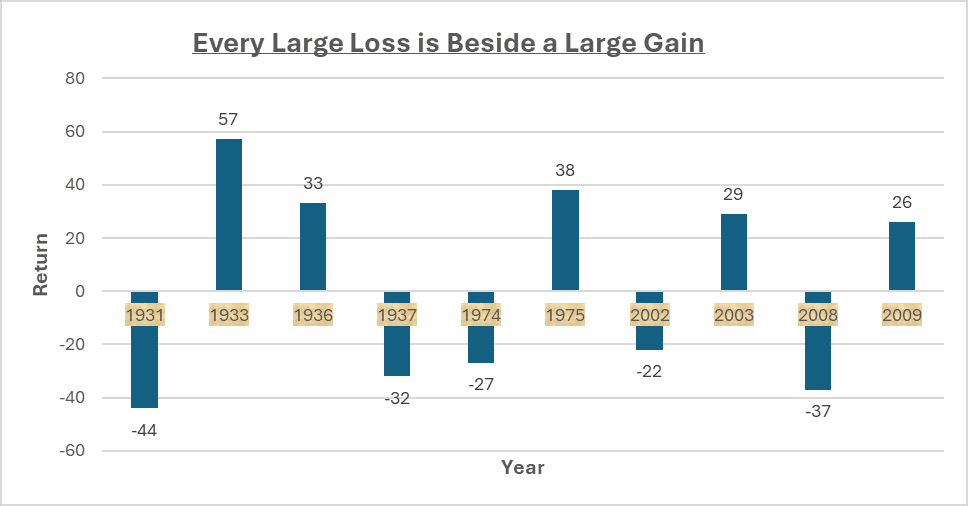

Here are the largest calendar losses of the S&P500. Note they all have a large gain either just before or after. It’s not random.

We can use this to assume that any large loss is highly likely to be followed by a large gain. In other words, a large loss, say over 20%, has reliably been a great time to invest.

Note that assuming large gains will be followed by a large loss does not work. This is because large gains are very common. Large gains are often followed by another large gain. Since 1926, 37% of all years were gains of more than 20%, but only 6% of years were losses of more than 20%.

In short, large losses are rare and almost always followed by large gains. Large gains happen a lot, so you can’t use them to predict the next year.

An easy way to beat the market.

The market is not random and we know large losses are highly likely to be followed by a large gain.

Here is an easy way to beat the market. Stay fully invested all the time to get a return very similar to the market. Then any time there is a decline of more than 20%, use it as a buying opportunity.

If you are fully invested, how can you buy more? Get creative. There are many ways, such as:

- Contribute 2 years of contributions in one year.

- Invest from a small credit line and use your annual or monthly contributions to pay it off.

- Start a plan of borrowing to invest.

There are many ways to invest more if you are creative. The important point is to recognize that it is a good buying opportunity.

Note it is not worth delaying investments to wait for a large loss since they are relatively rare. Only 6% of years have a loss over 20%, which means they average every 17 years. It is often not that long between them, but usually too long to wait with an investment.

This is a simple rule of thumb we have been using for years to get higher returns. Any time there is a decline of more than 20%, use it as a buying opportunity.

For example, on February 10, 2009, I published a post on this blog “How to Take Advantage of the Market After the Crash of 2008”. The market had just fallen 40% the prior 6 months. Investors dumped their stocks in huge numbers with $35-40 billion in net redemptions from the stock market that month. However, with our simple rule of thumb, this was obviously a huge buying opportunity. The market ended the year up 26% even though the first 2 months were down.

Similarly, in the Covid crash of March, 2020, the market fell 34% in a month. Obvious buying opportunity – right? It then essentially recovered in only the next 2 months.

The “random walk theory” is a myth. If it was true, we would not have a simple rule like this to reliably beat the market.

Ed

Planning With Ed

Ed Rempel has helped thousands of Canadians become financially secure. He is a fee-for-service financial planner, tax accountant, expert in many tax & investment strategies, and a popular and passionate blogger.

Ed has a unique understanding of how to be successful financially based on extensive real-life experience, having written nearly 1,000 comprehensive personal financial plans.

The “Planning with Ed” experience is about your life, not just money. Your Financial Plan is the GPS for your life.

Get your plan! Become financially secure and free to live the life you want.

Thank you for this. Very important to keep in mind!