Are you “Smart Money” or “Dumb Money”?

Amateur investors often look down on professional fund managers thinking they are not worth their fees. Meanwhile, professional fund managers tend to think of amateur investors as “dumb money”.

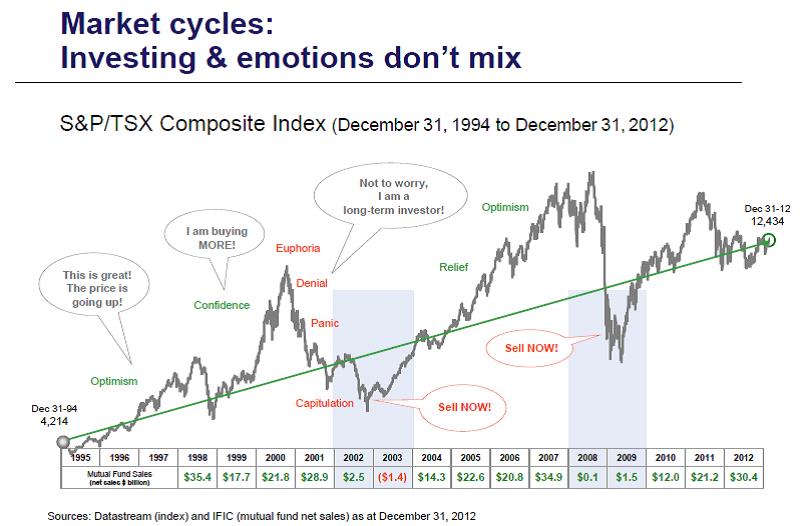

What is “dumb money”? It is investors that invest when the markets are high and then sell when the markets are low.

This is the natural way that investors with a human gut tend to invest. The human gut tends to make investors momentum investors. They feel more confident after the market is up and more scared after it has fallen.

In addition, “herding” means investors are more confident if they are doing what they think most other investors are doing. “Let’s all sell at the bottom together.”

How common is it for investors to be “dumb money”? Can you identify with the emotions on the chart below? Note the net new investments into mutual funds in the bottom. It shows that the vast majority of investors (the “herd”) bought at the top and then sold at the bottom.

One of my favourite quotes from Nick Murray is: “A bear market is a period of time during which common stocks are returned to their rightful owners.” “Dumb money” is the investors that invested between 2004 to 2007, and then gave away their shares to “smart money” investors in 2009.

How significant is this? According to Dalbar, the average investor lost 58% of their return each year over the last 20 years by buying high and selling low. Note that is the average of all investors. That means that half of investors lost more than 58% of their return per year and half lost less than 58% of their return.

How do you know whether you are “dumb money”? Here are some simple tests:

- Did you have a smaller portion of your investments in the stock market in 2009 than 2008?

- Do you feel more comfortable when you hear that other investors are investing similar to you?

- Do you think you gut is helpful in determining when to invest more aggressively and when to be more conservative?

If you answered yes to these questions, then I’m sorry to tell you this, but you are “dumb money”.

Don’t feel too bad, though. Most investors are part of the herd and there are some simple solutions.

What is the dumb money doing today? They are investing conservatively or for income:

- In mutual funds, $27.4 billion was invested in balanced and income funds, $19.0 billion went into bond funds, while $14.1 billion was redeemed from equity funds in 2012. (IFIC)

- 9% of net dollars invested into ETFs was invested in fixed income in 2012 (Bloomberg).

I always like to follow what most investors are doing. It is quite a reliable negative indicator. Since most of our clients are 100% in equities, I find it reassuring that the “herd” is going in a different direction.

What can you do to join the “smart money”? Here are a couple simple solutions:

- Become a buy and hold investor. Don’t try to time the market. Choose your investment mix of quality investments and stick with it. It sounds boring, but it works for Warren Buffett.

- Ignore your gut. Professional investors usually have a discipline to help them ignore their gut. Your Stone Age human gut has been genetically designed to run in fearful situations and attack when we smell food, all of which is utterly useless for investing. If you think your gut helps you with investing, I have news for you – that is your Stone Age brain not realizing your Stone Age gut is useless for investing.

- Never reduce your exposure to the stock market after a crash. That is the Big Mistake in investing. If the market falls by more than 20%, your exposure to the stock market must be as high or higher than it was before the fall.

With faith in your investments long term, patience, and discipline, you can join the “smart money”.

Ed

Planning With Ed

Ed Rempel has helped thousands of Canadians become financially secure. He is a fee-for-service financial planner, tax accountant, expert in many tax & investment strategies, and a popular and passionate blogger.

Ed has a unique understanding of how to be successful financially based on extensive real-life experience, having written nearly 1,000 comprehensive personal financial plans.

The “Planning with Ed” experience is about your life, not just money. Your Financial Plan is the GPS for your life.

Get your plan! Become financially secure and free to live the life you want.

Hi Mark,

Dividend investing is a brain fart. It’s the odd belief that taking money out of your investment does not take money out of your investment. It is exactly like selling a bit of your investment regularly, except for tax differences (usually higher tax) and the company controls the amount & timing (not you). More info here: https://edrempel.com/self-made-dividends-dividend-investing-perfected/

There are good and bad in growth stocks and in dividend stocks. The most effective investing is to invest in companies based on investment criteria, such as growth potential/risk/valuation, and not based on their category.

Ed

I recently read that dividend stocks should be avoided and growth stocks should be embraced or you won’t have the retirement you want. Okay, a couple in their retirement has 2 million invested and their goal for income is $80,000/ year. They could easily get that with good quality dividend stocks so what’s the incentive to go with growth stocks. And let’s take the kid’s inheritance out of it as they don’t have any and they would like to spend every dime themselves before they die. That’s us!

Thanks as always for your thought provoking blog.

Mark