Retirement Rookie: Worried about a Market Crash Right After Retiring?

Being worried about a market crash right after retiring is a major fear for many people both before and after taking the plunge. I often hear these anxieties:

“I’m scared to retire even though I have enough money in every projection. What happens if there is a market crash right after I retire?”

“We just retired, but are hesitant to spend money in case we have a market crash.”

You’re not alone—thousands of people have had the same worry. But does the data actually support this fear?

In my latest video, podcast episode, and blog post you’ll learn:

- Do we need to worry about a market crash right after retiring?

- Should we have the same worry in future years?

- Can I really be financially independent for life?

- How can I confidently take the plunge and retire when the market might crash?

- What should you do when the market crashes during retirement?

- Should I go back to work?

- What has happened in history with market crashes during retirement?

- What types of investments most reliably provide a solid income for a 30-year retirement?

- How can you let go of the fear?

Do we need to worry about a market crash right after retiring?

A client recently asked me, “When we reach financial independence, can we retire, or do we have to worry about a market crash?”

These clients have a Retirement Plan. They know the lifestyle they want through their retirement and have more than enough investments to provide for the rest of their life. But they are still worried.

We have confidence in the process from reading many studies on retirement, including some of my own, such as my “Is the 4% Rule Safe?” study that all show when and how retirement works. For example, my 4% Rule study shows:

– How likely portfolios of various asset allocations can provide for a 30-year retirement.

– Portfolios with 70-100% in equities provided for a 30-year retirement 96-97% of the time in the last 150 years.

– The big risk is inflation, not a market crash. Only once in the last 150 years was a market crash the reason that a 100% equity portfolio did not provide for a 30-year retirement.

However, it has been our personal experience that has given us the most confidence. We have had clients that experienced the worst-case scenario.

We had a few clients that saved the amount they need in their Financial Plan. They were financially independent and never needed to work again. So, they retired. Unfortunately, it was the summer of 2008. 6 months after they retired, their investments were down 40%! 2008 was the largest market crash since the 1930s and it happened quickly in only about 6 months. This was the worst-case scenario.

What did we do? We kept sending them the cash flow in their Financial Plan and monitored their withdrawal rate. We have a detailed process for this. In a couple cases, we reduced their cash flow by $100-300/month. In 2-3 years, their investments recovered.

From the market bottom in early 2009, the stock markets had an 11-year bull market with no significant down turns.

In short, their retirements are going very well, despite the largest market crash since the 1930s happening right after they retired.

Bottom line: Market crashes have happened every few years in history and markets have always recovered. 88% of declines were fully recovered in 1-2 years. A market crash right after you retire should not be a problem for you, as long as you stay invested and allow your investments to recover.

Should we have the same worry in future years?

Ever heard the wisdom, “Today is the first day of the rest of your life.”? It’s about looking forward. This is good advice every day.

The same wisdom applies to retirement: “This year is the first year of the rest of your life.”

That applies every year you are retired, not just the first year. I often wonder why people worry about the first couple years of retirement, but not the 5th year or 10th year.

Are the first years different than later in retirement?

I have comments on my blog arguing that later is both better and worse. For example:

– Some comments say it is worse for 80-year-olds because they do not have enough time for their investments to recover from a crash.

– Other comments say that it is less of a problem later because initially you have to fund a 30-year retirement, while 80-year-olds only have to fund maybe 15 years.

Who has more to worry about – retirement rookies or experienced retirees?

Let’s compare 15-year to 30-year periods. Here are the rates of return you need to provide your retirement withdrawing 4%/year from your investments (4% Rule) rising by 3%/year inflation compared to the worst calendar return of the S&P500 for the modern stock market (since 1930):

15-years 30 years

Return needed to fund your retirement -2.0%/year (loss) 2.2%/year

Worst calendar return of S&P500 since 1930 1.4%/year 9.2%/year

Worst return above the minimum needed 3.4%/year 7.0%/year

For shorter periods of time, your investments may not even have to grow. However, over 30 years, you can be much more confident of a high stock market return.

Bottom line: Retirement rookies should be more confident than experienced retirees, not less.

In both cases, a 100% equity portfolio provided for your retirement even in the worst period, plus a very comfortable margin.

Can I really be financially independent for life?

Retiring with confidence is exactly why you need a Financial Plan. It is the GPS for your life. It will tell you exactly what you need to provide for your desired lifestyle for the rest of your life.

It needs to be based on the actual lifestyle you want to live through your retirement (before tax), not a percentage of your preretirement income. It needs to include conservative estimates for both inflation (at least 3%/year) and the return of your investments with your asset allocation. For example, since 1930, the worst 25-year return of the modern stock market has been 8.0%/year and the US bond market 1.9%/year.

How can I confidently take the plunge and retire when the market might crash?

This is still a common fear. By all math and financial planning, you have more than enough to retire with your desired lifestyle for life. However, taking the step to retire can still be scary. In most cases, you can’t easily un-retire if things go wrong.

Making it worse is that it is not only your paycheque you give up when you quit your job. You might also lose the daily routine of a job, your sense of accomplishment, and your friends at work.

If you have done the math yourself, there might be reasons to be hesitant. Are you sure you didn’t make a mistake or use unrealistic assumptions or miss something?

Having a trusted financial planner can make the difference for you. Independent professional advice can give you confidence in your decision.

Quite a few of our clients became clients when they retired. They felt okay managing their own finances during the accumulation phase of their life, but were not confident about taking the plunge or managing their finances during decumulation in retirement. They also didn’t know how to setup a retirement income most effectively and tax-efficiently.

Retiring confidently can be a great moment. Like crossing the finish line in a race with your arms up to celebrate. You made it! You can now enjoy the rest of your life. You have financial freedom and time freedom.

What should you do when the market crashes during retirement?

If you are retired for 30 years or more, there will be several major market declines in that time. There have been hardly any 30-year time periods in history without a decline of 20% or more.

You need to plan ahead of time for what you will do when it happens. Note, not if it happens.

We call this “lifeboat drills”. First of all, you should never panic and sell because of a market decline. If you have good investments, they should be even better at lower prices. Selling means you miss the inevitable recovery, and you lose future returns you could have had.

It’s like fear of turbulence in an airplane. Once you have decided to fly, you will likely occasionally have some turbulence. The worst thing you can do is get out of the plane! Just tolerate it and everything should be fine in a while.

You also need tools to tell you if you need to make changes in your life. For example, here are a couple tools we use:

· Track your withdrawal rate. If your investments are down and you continue to withdraw the same cash flow for your lifestyle increasing by inflation, your withdrawal rate will be higher. It is different for different asset allocations, but for a 100% equity portfolio a 4%/year withdrawal should be safe, 5% means you should watch it, 6% means you should think about starting to spend less.

· Track your withdrawal rate assuming a recovery. Based on history, the markets have always recovered eventually from every decline. If your investments are down quite a bit, say 20% or more, what will your withdrawal rate be after your investments have recovered? We usually wait a year or 2 after a major market crash before recommending you make significant lifestyle changes.

Should I go back to work?

It may or may not be possible for you to return to work, depending on your profession. You may be able to go back part time or become a consultant using your expertise. Or just get a job that is easy for you to bring in a bit of income.

We have never had a case where returning to work was necessary. Reviewing your plan regularly and possibly making modest lifestyle changes has always been enough.

What has happened in history with market crashes during retirement?

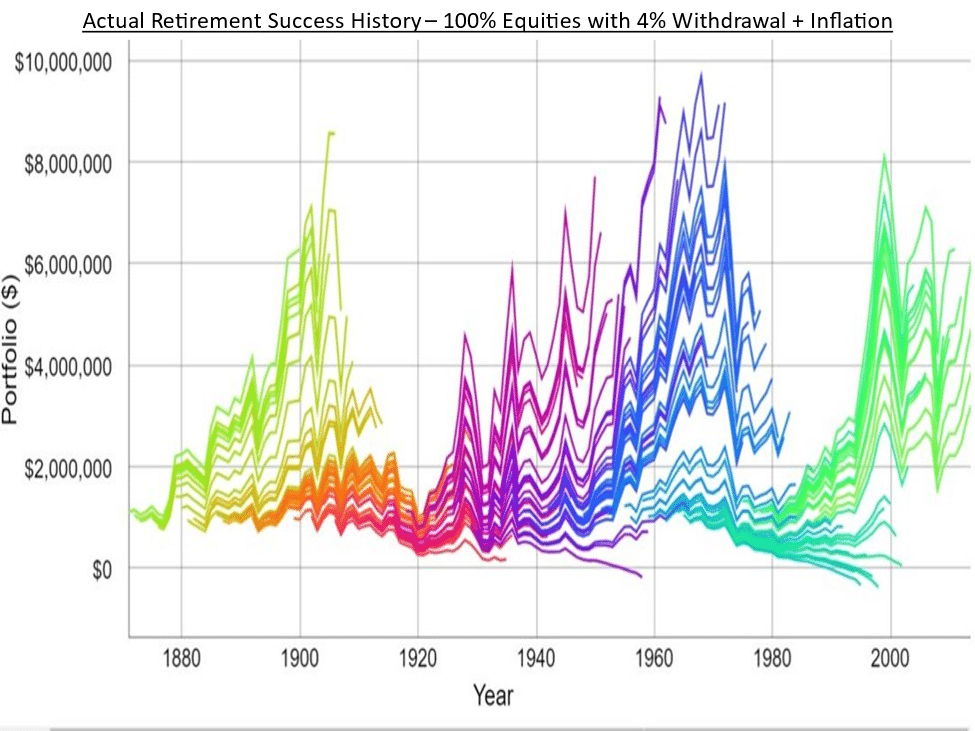

Looking at actual history for the last 150 years to see what happened during 30-year retirements can give you confidence.

In this graph, every line is a 30-year retirement starting that year, withdrawing 4%/year the first year and increasing your income every year by inflation.

Note that the portfolio only hit zero 5 times:

· Once because of a market crash for people that retired in 1929, right before the biggest crash in history and the Great Depression. The government did not know how to manage the economy then and kept doing things that made it much worse.

· 4 times because of high inflation for people that retired in the late 1960s just before the high inflation in the 1970s and 1980s.

Note what you should really fear is inflation – not a market crash.

A market crash has only caused a retirement to fail once. This was the 1929-1932 crash when the market fell 82% over 4 years. Even then, retiring in 1929 failed, but retiring in 1930, 1931 or 1932 succeeded.

There have been a few other major market declines, but a 100% equity portfolio has recovered from all of them and still provided for a 30-year retirement.

What types of investments most reliably provide a solid income for a 30-year retirement?

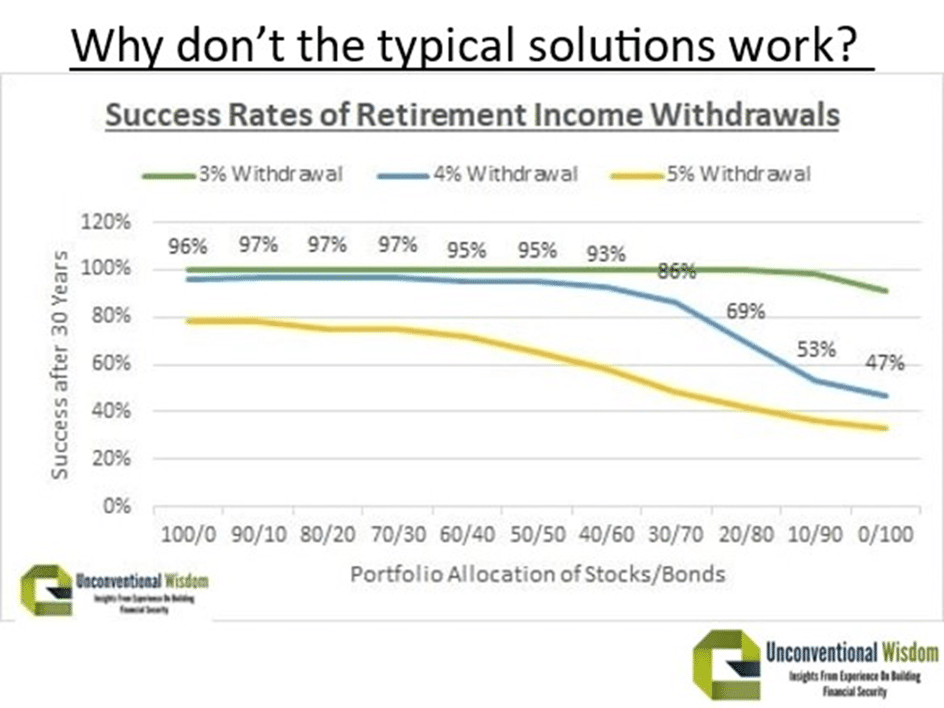

There is a common belief that bonds or fixed income is “safer” than equities (stocks), so retirement rookies might be tempted to try to be “safer” to deal with their fear. Bonds have been safer for shorter periods of time, but equities have been safer through a 30-year retirement.

You need an income that rises through a 30-year retirement, not a fixed income. The return on bonds is often barely above inflation, providing little for all your future retirement years. There have even been quite a few 30-year periods where bonds were still down after inflation after 30 years.

I have a few posts about this. Bonds have a higher standard deviation after inflation than stocks for periods of 20 years or more in history. That means we can more accurately predict there the stock market will be after inflation 20 years from now than the bond market.

The main issue with bonds is that they get killed by inflation. If there is a higher inflation period any time during your retirement and you have mostly bonds, your retirement might be at risk.

The chart below shows the actual success rates for providing for a 30-year retirement during the last 150 years. Note that generally the higher your allocation to stocks, the more reliable your retirement has been.

The highest success rates have been for 70-100% equities with a 4%/year withdrawal and 90-100% for a 5%/year withdrawal.

Note that in every case, the more you have in stocks, the higher your retirement income can be over 30 years. Stocks very reliably outperform bonds over 30-year periods. Usually several times higher.

Equities might feel scary right when you retire or right after a market crash. However, they have been more reliable for providing both a higher retirement income and a more reliable retirement income.

How can you let go of the fear?

You can let go of the fears of being a retirement rookie by planning it solidly to give you confidence. A Financial Plan and professional advice can make all the difference.

The Retirement Rookie time can be the best time in your life. Enjoy all your new freedom!

Ed

Planning With Ed

Ed Rempel has helped thousands of Canadians become financially secure. He is a fee-for-service financial planner, tax accountant, expert in many tax & investment strategies, and a popular and passionate blogger.

Ed has a unique understanding of how to be successful financially based on extensive real-life experience, having written nearly 1,000 comprehensive personal financial plans.

The “Planning with Ed” experience is about your life, not just money. Your Financial Plan is the GPS for your life.

Get your plan! Become financially secure and free to live the life you want.