Go Big or Go Slow: Why 10x Wealth Is Easier Than 2x

This title may be hard to believe, but it is a common theme in coaching for small business entrepreneurs.

The concept is from the popular book “10x Is Easier Than 2x: How World-Class Entrepreneurs Achieve More by Doing Less” by Dan Sullivan and Dr. Benjamin Hardy.

Most of us think about incremental improvements in our lives, not dramatic life-changing improvements. That would require a completely different way of thinking.

The 10X concept works for entrepreneurs. You can also use the 10X concept to dramatically improve your finances.

In my latest video, podcast episode, and blog post you’ll learn:

- Why does this concept work for world class entrepreneurs?

- Stories of how and why it worked.

- Why can becoming 10 times wealthier be easier than 2 times?

- How can this idea be used for your finances?

- What specific concepts can give you 10X wealth?

- How can you figure out what 10X concepts might be right for you?

This is a unique post that is a completely new way of thinking. It includes some insight into my mind and my life.

Let’s start by looking at how entrepreneurs use it and then see how this could be applied to your finances.

Why does this concept work for entrepreneurs?

Most small business owners are constantly thinking about how to improve their business. Most would be thrilled if they could double their sales or profits.

If they think about how to get 2 times their income, they assume that means they would have to work 2 times as hard. Considering most small business owners already work long hours, it feels daunting to them.

There are many ways to be 2X as successful with incremental improvements in one area or another, or just working 2 times as hard or as long. But none of this is easy.

Achieving 10X success requires doing things completely differently, such as:

- Exponential, not linear thinking: Focus on high-impact activities. Ask what could create 10X growth?

- 80/20 principle: Focusing your strategy to focus on the 20% of your effort that gives you 80% of your results. Commit to abandoning the 80% that does not serve your bigger vision.

- Leveraging principle: Leveraging your time with the “Who Not How” principle to hire people, instead of trying to figure out how to do everything yourself. Focus on your unique ability.

- Simplifying principle: Identifying & removing non-essentials. Build a self-managing system.

- Plan principle: Have a Plan for dramatic change. Dramatically changing your vision to focus on the 4 freedoms: time, money, relationships, and purpose.

All of this is part of the Strategic Coach program, who have been giving me exceptional coaching for several years. I highly recommend their program as the most effective business coaching program for entrepreneurs in North America.

Stories of how it worked.

An interesting story from the book is the story of Linda McKissack. She was a real estate agent working hard to sell more houses. Working hard to try to get 2X results.

Then after getting some effective coaching, she decided on a completely different model several times and achieved a 10X result each time.

First, she changed her focus to only seeing clients. She hired an assistant to do everything else. This was the leveraging principle because administration and research had taken 80% of her time. Seeing clients was her unique ability. That gave her 10X the income.

Then she did another 10X by only getting listings from sellers and not working with buyers. She referred all buyers to other agents. This was the 80/20 principle because listings had given her 80% of her income. That gave her 10X the income again.

Then she did another 10X by hiring an agent to do all the listings and not even seeing clients, so she could manage and then become the owner of her real estate brokerage with a bunch of real estate agents working for her. This was the leveraging “who not how” principle to leverage her time. This was another 10X on her income.

Then she did another 10X by leveraging her time to find and train a good manager to manage her brokerage. With her extra time, she bought 27 other brokerages and focused on having a good manager in each one. This was the leveraging principle to leverage her time. This was another 10X on her income.

She found it difficult at each step to let go of familiar but restrictive practices that took 80% of her time, but each step allowed her to focus on the 80% high result areas. The result was that she had less work while making 10X the income several times.

The story is a fascinating read in the book because she did 10X several times. In total, she turned a $50,000/year income into a multi-billion dollar business with a few 10X steps. Each 10X was less work, while making 10X the income.

My story:

My personal story follows the 10X concept with a dramatic improvement by changing to a completely different model. For many years I was a traditional mutual fund financial planner. I wrote comprehensive financial plans for free and was paid with an up-front commission. I wanted to manage all aspects myself, including writing the financial plan and on-going advice and reviews, but also managing all the investments and insurance. We worked many long hours trying to slowly grow our practice. It was lots of hard work trying for a 2X result.

Then I made the dramatic change to a completely different model. I became a fee-for-service financial planner. We focused on only financial planning – what clients really need. We outsourced all products.

This worked because we found so many people could not find unbiased, comprehensive, genuine financial planning to help them plan their lives, but they could find investment advice all over. This was the 80/20 principle with financial planning being 80% of the benefit clients needed.

Letting go of managing the investments was hard, but hugely beneficial. It was time-consuming. I found a top independent portfolio manager to manage investments for myself and our clients, and found he has many advantages over what I could do myself. He can buy almost any type of investment, he can do mass portfolio changes for many clients and accounts at once to keep portfolios close to his targets, which means he can make portfolio changes for many clients in days, not months. He also has a fiduciary duty to act in the best interests of our clients.

I also outsourced insurance. I found an insurance advisor who wouldn’t try to upsell our clients to more expensive policies.

I started to charge for a comprehensive financial plan, instead of getting investment commissions, so it is clear we are transparent and unbiased. Clients could decide whether their Financial Plan was worth the fee. On-going advice is paid with a transparent monthly fee.

My wife, Ann, suggested we should only work with clients that were with us 100%. Full Service. The only way to be able to provide the best advice is if we know all about our clients’ finances. I was hesitant at first, but found it leveraged my time by only working with the people that really want our advice. It gave us the time to focus on them.

Charging for a Financial Plan and then only working with clients 100% with Full Service for on-going advice & plan reviews was the 80/20 principle. The clients willing to do both are the most valuable clients that understand the value of financial planning. This model means we only have the best clients.

It also means we can give the most effective advice. The most effective financial planning strategies can be quite unconventional. 100% mutual trust between us and our clients is the basis for being able to recommend more unconventional and effective strategies and ideas.

I was able to leverage my time by hiring and training several exceptional financial planners. It worked because I only had to train them in financial planning. They do not have to know about all the different investments and insurance policies available.

Being focused only on financial planning and hiring financial planners gave me time to start my blog, and later YouTube channel and podcast. For years I had written guest articles on other people’s blogs, but now was able to focus and write consistently for my own blog.

Our practice now is focused only on financial planning, while being fee-transparent, clearly unbiased, and both the financial planning & investment people have a fiduciary duty to our clients. It is a completely different model that is much better for our clients and much easier to manage because of our focus on comprehensive financial planning and not selling any products.

We used to do seminars to find new clients. Now, clients find us from my blog, YouTube & podcasts and from referrals. We have had a waiting list of 2-4 months or longer the entire time the last few years. We experienced dramatic improvement by changing to a completely different model.

Those are stories of entrepreneurs that show you how the 10X concept works. Let’s look at how you can use the 10X concept for your finances.

Why can becoming 10 times wealthier be easier than 2 times?

Becoming 2 times wealthier means you likely do most of the same things you are doing now, but try to do a bit more of them or do them a bit better. Go through your spending and see try to spend less. Maybe create a budget. Try to contribute a bit more to RRSP or TFSA. Try to find a better investment. Look for a way to save some tax.

It’s a lot of work trying to get a 2X result.

Achieving 10X wealth means doing things completely differently. Plan once for the best possible methods and strategies. Then let them work.

How can this idea be used for your finances?

Here are a few ideas. You should think of them as general concepts, not necessarily as anything specific.

Let’s start with 2 examples of a 10X return on investment.

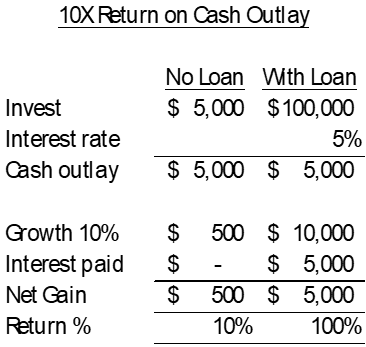

1. Leverage: Use your cash to pay investment loan interest instead of investing.

Leveraging time is effective. Leverage is also a highly effective financial strategy for the right people done the right way over the long-term. For people that really want to grow their wealth, how much they leverage (borrow to invest) is a bigger factor than the specific investments they have.

Let’s compare investing cash to using the same amount of cash to pay interest on an investment loan:

This is a 10X return on investment and can be a reasonable long-term expectation. However, huge caveats here. The stock market generally averages about 10%/year long-term, however, it rarely has a return close to 10%. You have to be able to stay invested for the long term if you want to get this long-term return. If you sell any time because your investment has gone down, then this is probably not a good strategy for you.

Using your cash to pay investment loan interest instead of investing it is a completely different way of thinking with a possible 10X return if done right.

There are many strategies to do this, such as some effective growth strategies that also use the concept of paying investment loan interest instead of investing your cash, such as:

The Smith Manoeuvre for homeowners.

Lifecycle Investing for younger people.

Rempel Maximum for people wanting aggressive growth.

Links are provided for these strategies, if you want to learn about them.

Note that trying for a 2X return likely means trying to spend less so you can invest 2X as much. That can be a lot of work and constantly focusing on saving a bit of money.

This type of 10X strategy can be no additional work at all. Just get the loan and make the payments. No need to reduce your spending.

2. 100% equities: Invest for growth instead of a conventional wisdom balanced or income portfolio.

Become educated about investing and hold 100% equities instead of a balanced or 60/40 allocation. This is the difference between an 8%/year long-term return on equities vs. a 5%/year long-term return with balanced or income investing. That is doubling your money 9 times over 30 years, instead of 6. Three extra doubles would be an 8X growth. Not for everyone. Highly effective if you can stay invested over the long term.

Some concepts are not 10X on their own, but can be combined within your overall Plan so that the benefits compound. For example, combining concepts with a 70% benefit, a 40% benefit, a 20% benefit, and a 10% benefit gives you a total of 3.1X more wealth.

These concepts can give you 20% or 50% or 70% more wealth without investing more:

RRSP Gross-up: Doing it every year can give you 40-70% higher RRSP contributions with the same cash flow.

RRSP vs. TFSA decision: Tax savings from getting the RRSP vs. TFSA decision right, or from contributing the optimal amount to RRSP/FHSA to bring your taxable income exactly to the bottom of your tax bracket. This means you get the larger tax refund on every dollar. It can be a 10-20% benefit or more for you every year.

Self-made dividends: Instead of investing for income, invest for growth in tax-efficient investments and sell a bit monthly or whenever you need cash flow. The combination of higher growth investments, investing outside of Canada, and less tax can be a 2X or 4X for you.

Retirement income only in low tax brackets: Design your retirement income by withdrawing from different types of accounts to target a specific low tax bracket. This means you pay a lot less tax. It can be a 10-20% benefit or more for you every year.

These concepts are aggressive and must be done right by the right people for the long-term. I highly recommend getting professional advice if you want to implement these concepts or strategies.

How can you figure out what 10X concepts might be right for you?

Dramatic change requires a Plan.

Financial Plan: It is the GPS for your life. Having a Financial Plan so you know exactly the optimal use for every dollar usually has major benefits that are different for everyone. It can lead you to do things completely differently. Following it consistently, not just some of the time, also has major benefits.

From experience, the most effective way to achieve 10X wealth is to create your Financial Plan. It is the GPS for your life. It makes it clear what possible future lives are or are not possible for you. There are many effective concepts that may or may not be right for you, but you can see how each one could affect your life.

Your Financial Plan allows you to choose your future. The process of creating it involves planning your life and seeing how different concepts might work for you. It makes it clear for you exactly what to do to achieve the life you want.

An “interactive financial plan experience” allows you to ask many what-ifs, such as:

· When can you retire with the life you want?

· What would it take to retire sooner?

· What would it take to retire more comfortably?

Our software is interactive and very flexible to be able to show you many possible future lives within seconds, so you can decide which one to live.

From experience, the process of creating their Financial Plan can lead many people to change what they do dramatically. Find out which 10X concepts might be right for you.

Create your Financial Plan and figure out how you can achieve 10X wealth.

Ed

Planning With Ed

Ed Rempel has helped thousands of Canadians become financially secure. He is a fee-for-service financial planner, tax accountant, expert in many tax & investment strategies, and a popular and passionate blogger.

Ed has a unique understanding of how to be successful financially based on extensive real-life experience, having written nearly 1,000 comprehensive personal financial plans.

The “Planning with Ed” experience is about your life, not just money. Your Financial Plan is the GPS for your life.

Get your plan! Become financially secure and free to live the life you want.