The Fake Stages of Retirement: Why ‘Slow-Go’ Is Really About Money — Not Age

You’ve probably heard the conventional wisdom about retirement stages: the “go-go” years right after you clock out, full of adventure and travel; then the “slow-go” phase where things wind down due to age and aches; and finally, the “no-go” period of quiet homebound days. It’s a neat little narrative, peddled by financial planners and lifestyle gurus alike.

But what if I told you it’s mostly a myth? That “slow-go” isn’t about creaky knees or fading energy – it’s usually just code for “didn’t save enough”. Today, we’re busting that myth wide open with hard data, real surveys, and some eye-opening figures.

Stick around, because if you save like you mean it, your 80s could look more like Ibiza than a rocking chair.

In my latest blog post you will learn:

- Why the traditional “Go-Go, Slow-Go, No-Go” retirement stages are largely a myth

- That retirees with strong finances and good health often keep travelling well into their 80s

- How average retirees see only a modest drop in travel spending between ages 75–84

- Why wealthier retirees typically maintain high travel spending with little slowdown

- That many retirees don’t save enough — making them vulnerable to even small cost increases

- Why reduced travel is usually caused by money concerns, not inevitable aging

- How financial stress shows up in every “stage” of retirement — including the so-called “No-Go” years

- Why overly conservative investing can reduce retirement income dramatically compared with growth portfolios

- How better financial planning can help you stay active, independent, and engaged longer

Traditional retirement stages (“go-go”, “slow-go”, “no-go”) are largely a myth.

Let’s start with the basics. The idea of retirement phases traces back to financial planning models from the 1980s and ’90s. In the “go-go” stage, roughly ages 65 to 75, retirees are supposed to splurge on bucket-list trips, hobbies, and experiences—spending peaks here. Then, around 75 to 85, “slow-go” kicks in: less active pursuits, maybe local outings instead of international jaunts, as health supposedly declines. Finally, “no-go“ after 85: medical bills rise, travel halts, and spending drops to basics. Sounds logical, right? But recent surveys paint a different picture. It’s not age dictating the pace—it’s your bank account.

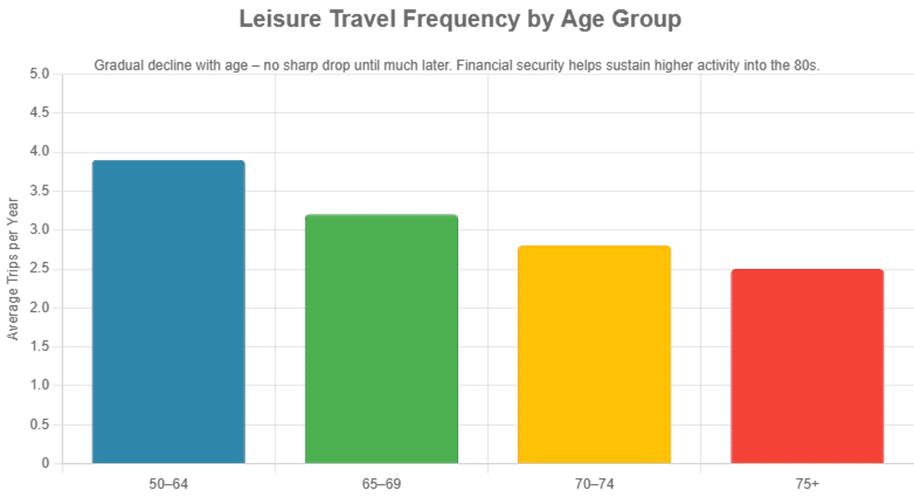

Take travel, the hallmark of an active retirement. An RBC Wealth Management poll echoes this, with 63% of Americans over 50 listing travel as a top retirement goal. According to a 2025 AARP study, adults aged 50 and older are traveling more than ever, averaging 2.5 to 3.9 trips per year. That’s not just the young retirees; data and our experience working with thousands of Canadians show that when seniors are financially secure and physically able, they keep going strong well into their 80s.

Let’s look at some statistics. AARP data show only a modest decline in the number of trips as retires age.

Before retiring at age 50-64, the average is 3.9 trips/year. For age 65-69 it’s 3.3 trips/year, age 70-74 it’s 2.8 trips/year, and for 75+ it’s 2.5 trips/year. Regular travel for all age groups.

Let’s look at some statistics. AARP data show only a modest decline in the number of trips as retires age.

Before retiring at age 50-64, the average is 3.9 trips/year. For age 65-69 it’s 3.3 trips/year, age 70-74 it’s 2.8 trips/year, and for 75+ it’s 2.5 trips/year. Regular travel for all age groups.

Travel & activity levels remain high into 80s+ for those who are financially secure & healthy.

Here’s the key: for those over 80, travel doesn’t crater until real health issues hit, like in the 90s or when mobility truly fails. Solvent, healthy octogenarians are still booking cruises, golf trips, and family vacations – just more luxurious and less strenuous. Internet discussion threads from retirees confirms this: many say they only slow down in their mid-80s, and even then, it’s often due to budget constraints, not just age. Think relaxed ocean voyages or resort stays, not backpacking. Real spending on adventures holds steady or even shifts upscale until serious health tanks it.

Average retirees see only modest travel spending drop in 75–84 age range.

Spending on travel for average Canadian retirees tends to stay high into the mid-80s or later:

| Retirement Stage | Age Group | Estimated Annual Spending (2025 CAD) | Key Notes |

| “Go-Go” | 65–74 | $6,500 – $8,000 | Peak: multiple trips, snowbirding, bucket-list. |

| “Slow-Go” | 75–84 | $4,800 – $6,200 | Modest ~20–25% drop; shift to cruises/resorts. |

| “No-Go” | 85+ | $1,800 – $3,500 | Sharp decline when health limits most. |

Let’s put real Canadian dollars on it. For the average retiree, “go-go” spending hits $6,500 to $8,000 a year—multiple trips and adventures. In “slow-go”, it’s a modest drop to $4,800 to $6,200, about 20-25% less, often on cruises or resorts. Only in “no-go” does it crater to $1,800 to $3,500, when health truly limits most. So, why do so many enter “slow-go” early? Spoiler: It’s the money.

Wealthy retirees maintain high travel spending in all stages with minimal slowdown.

Now contrast that with wealthy Canadians where money is not an issue – those with more than a million in assets. Their “go-go” phase? $25,000 to $50,000 or more annually, on bucket-list global trips and multi-generation trips. “Slow-go” holds at $20,000 to $45,000, shifting to ultra-luxury cruises and deluxe snowbird stays. Even “no-go”? $10,000 to $30,000 on assisted high-end getaways.

For them, the fake stages barely exist – finances keep the pace elite until health says otherwise.

When money is not an issue, spending on travel for wealthy Canadian retirees stays high into the 90s or later:

| Retirement Stage | Age Group | Estimated Annual Spending (2025 CAD) | Key Notes |

| “Go-Go” | 65–74 | $25,000 – $50,000+ | Bucket-list global travel, multi-generation trips, business class |

| “Slow-Go” | 75–84 | $20,000 – $45,000+ | Ultra-luxury cruises, deluxe snowbird stays |

| “No-Go” | 85+ | $10,000 – $30,000 | Assisted high-end options still possible |

Many retirees have inadequate savings; half are “broke” or highly sensitive to small cost increases.

Enter the harsh reality: Half of retirees are essentially broke, forcing them into premature slowdowns. A USA Facts analysis reveals that 46% of American households have zero retirement savings. An AARP survey ups the ante – 20% of adults 50+ have no savings at all, and 61% worry they won’t have enough to support themselves in retirement. Forbes reports that nearly half of households will run short if they retire at 65. And in Canada, an IG Wealth Management study with Pollara Strategic Insights found that 80% of respondents say rising costs are challenging their retirement readiness, with many prioritizing current spending over long-term saving.

Imagine this: 60% of retirees would skip vacations entirely if interest rates or costs rose by just 0.5%, according to polling data like Pollara’s insights on financial pressures. That’s not a dramatic hike – it’s a tiny blip in higher monthly expenses. Yet, for those living paycheck-to-pension, it’s enough to ground their dreams. Bankrate surveys show similar trends: inflation and rising costs are forcing over 80% of holiday travelers to alter plans, with many canceling altogether.

It’s not old knees keeping them home—it’s empty pockets.

Reduced travel is usually due to insufficient savings, not inevitable age-related decline.

And the data backs it: In “go-go” years, 45% to 51% blame finances for skimping on travel, versus just 21% to 29% for health. “Slow-go”? Still 40% to 45% finances, with health at 29%. Only in “no-go” does health surge to 46% or more, while finances drop to 30%. Without adequate savings, that “go-go” phase fizzles fast, turning into “slow-go” by default.

Looking only at finances and health (and not other reasons), 2/3 of retirees age 65-74 reduce travel for financial reasons, 60% of age 75-84, and even 40% of those age 85+.

| Retirement Stage | Age | % Citing Cost/Finances | % Citing Health | Finances vs. Health |

| Go-Go | 65–74 | 45–51% | 21–29% | 66% vs 33% |

| Slow-Go | 75–84 | 40–45% | 29% | 60% vs 40% |

| No-Go | 85+ | 30% | Up to 46% | 40% vs 60% |

Finances are the main issue for “go-go” & “slow-go” and a major issue even for “no-go” stage.

This is key. Even for retirees over age 85, reduced travel results from not having the money almost as much as not having the health.

The issue is poor prep – not old knees.

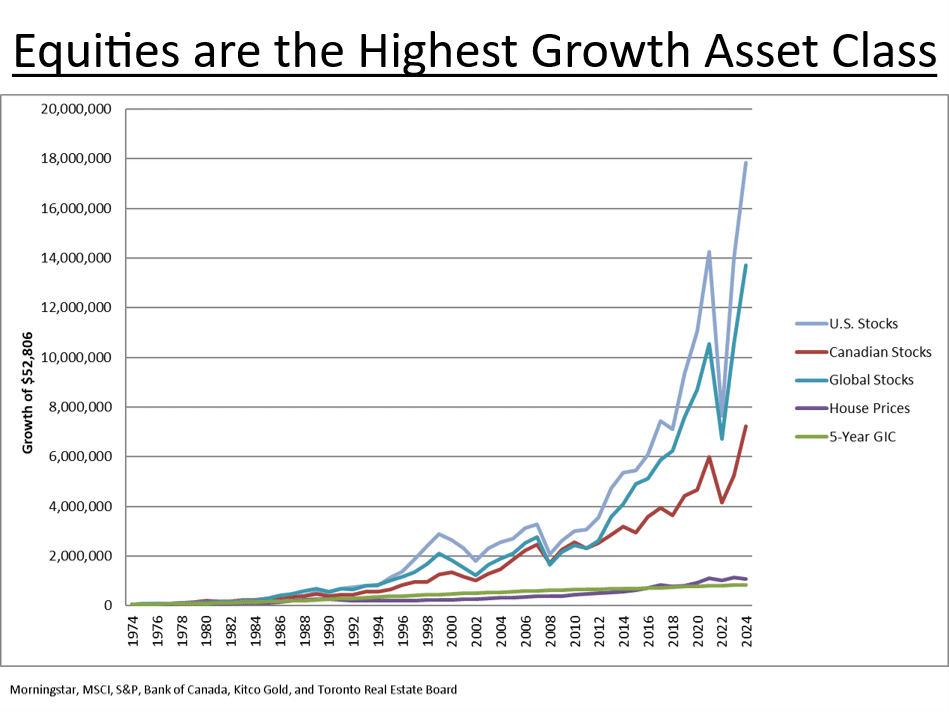

Conservative investing can reduce retirement investment income by 2/3 vs. growth portfolios.

But it’s not just about not saving—it’s about saving wrong. Many retirees play it too safe with investments, opting for ultra-conservative options like GICs (Guaranteed Investment Certificates) or the classic 60/40 portfolio (60% stocks, 40% bonds). While these feel secure, they can lead to significantly lower income over your entire retirement compared to more growth strategies.

A couple investing $10,000/year each from age 25 to 65 in equities earning 8%/year should grow a portfolio of $5,181,000 and be able to support a retirement income of $90,000/year just from their investments. If they invested in a balanced portfolio earning 5%/year, their investments should grow to $2,416,000 and can only support $28,000/year.

That’s only ½ if the retirement portfolio and 1/3 of the retirement income from their investments just because of more conservative investing.

Why does half the portfolio reliably provide only 1/3 of the retirement income?

Not only do more conservative investments mean a much smaller retirement portfolio, they also mean you should take a lower retirement income from it.

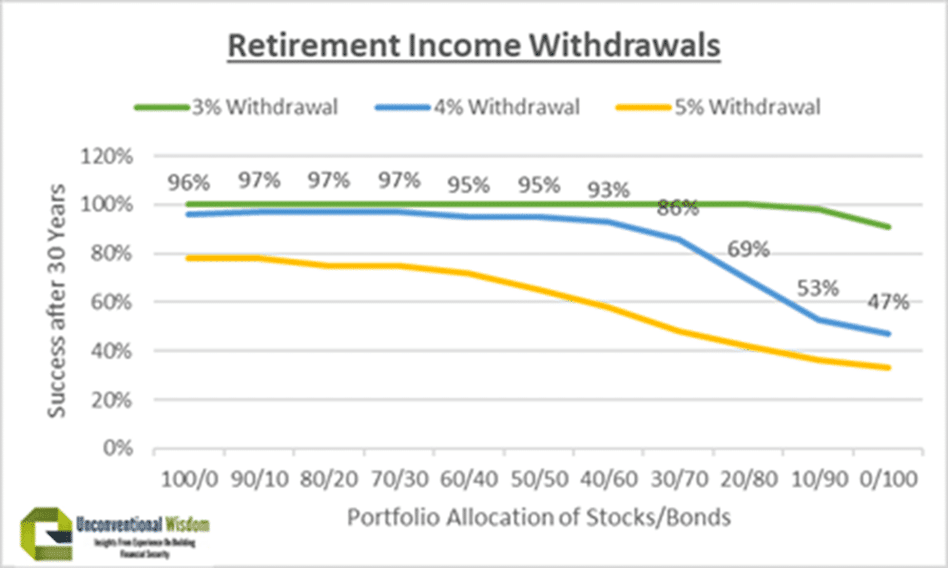

My research with the “4% Rule Study” shows the rule of thumb for a safe withdrawal rate is: 2.5% plus .2% for every 10% in equities. With no equities, a 2.5% withdrawal is safe. With 50% in equities, you add .2%x5 for a safe withdrawal of 3.5%. With 75% or more in equities, the 4% Rule should provide you with a reliable, inflation-adjusted retirement income.

In short, the safe withdrawal rate is 3.5% of your investments each year for a balanced portfolio, but 4%/year for an equity portfolio.

Combine that with a significantly smaller portfolio from conservative investing and you end up worrying about running out of money in retirement, so you cut back on your travel. That is what most retirees experience.

You can plan to be healthy longer.

Our experience helping thousands of Canadians with their finances is that those with money and health keep travelling and enjoying life. They generally spend as much in their 80s as they did in their 60s, with more luxury travel and less active travel. Eventually, it is health that slows them down.

You can also plan to be healthy longer. I read a fantastic book “Outlive” by Dr. Peter Attia and did a post about it: “How To Have a Long Lifespan, Healthspan & Wealthspan With 3.0 Level Thinking”.

The biggest lesson I learned in the book is that the big health issue with seniors is that they lose muscle mass when they get older and get feeble. Then they fall and break a bone that reduces activity, and then often experience a quick decline. The answer is a high-protein diet and weight exercises to keep up your strength.

You can do many other things, such as test to discover diseases early and stay active.

The point is that you don’t have to resign yourself to not being able to have travel, entertainment and fun in your life when you get into retirement. Plan to have enough money with effective saving and growth investing, and plan to have health with a protein diet and exercise.

You can plan for decades of enjoying life and doing what you find meaningful.

Poor financial preparation, not aging itself, forces premature lifestyle cutbacks.

Poor preparation, not inevitable aging, is the real culprit. A Forbes article nails it: The 60/40 portfolio is “dead” for longer lifespans. We’re living to 90+, needing growth to outpace inflation. Morgan Stanley agrees, urging a rethink for better diversification.

But flip the script: Save aggressively, invest wisely with a growth-oriented mix, and your golden years glow. Data from Road Scholar’s 2025 outlook shows 64% of retirees prefer flexible solo travel, proving desire doesn’t dim even if you lose your life partner.

With solid finances, 80 looks like Ibiza—partying with grandkids, exploring new spots, living large.

So, ditch the fake retirement stages. The issue is poor prep – not old knees. Retirement’s pace is in your hands—or rather, your portfolio. Start saving & investing like you mean it today, and tomorrow’s adventures await.

Now go plan that dream trip!

Ed

Planning With Ed

Ed Rempel has helped thousands of Canadians become financially secure. He is a fee-for-service financial planner, tax accountant, expert in many tax & investment strategies, and a popular and passionate blogger.

Ed has a unique understanding of how to be successful financially based on extensive real-life experience, having written nearly 1,000 comprehensive personal financial plans.

The “Planning with Ed” experience is about your life, not just money. Your Financial Plan is the GPS for your life.

Get your plan! Become financially secure and free to live the life you want.

Hi Yael,

I can confirm you are subscribed. If you are already subscribed when you try to subscribe, it does not subscribe you twice.

Ed

Hi Yael,

Thanks for telling me the subscribe button to “Get updates” was not working. I believe it is fixed now. Try it again.

Ed

Trying to subscribe to this great blog providing a valid email address, but gettig the following error message: There was an error subscribing. Please try again.

It’s impressive for several retirees I know personally from age 71 to 67, who are taking 2-4 foreign trips annually for past 4-5 yrs. Personally, I’m amazed.

Not quite that for self. I agree if it’s not travel expenses, there will be another expense later re: long-term care in future.

Great post Ed. I have been buying the narrative that the slow go /no go stages meant significant slow down in travel, driven by health realities. Now it’s just a case that the portfolio holds up to the travel dreams! Although at the age of 66, I am wary of being too long equities given current state of market, endless talk of Ai bubble, and so on! Hopefully the investment plan and newly increased travel plan works!