Why Renting Could Be Your Secret to Smarter Wealth Building

Owning a home is unaffordable for many people today. Here is some good news! If you rent, you can grow your wealth as fast or faster using the same 2 ideas that benefit homeowners.

Tenants have several major advantages over homeowners for wealth building.

Many homeowners think their home is their best investment. But that is unfortunate.

It is easy to find better investments with dramatically higher long-term returns.

Despite the lower returns, homeowners on average are wealthier for 2 non-investment reasons.

Tenants can use the same 2 ideas to grow as much or more wealth.

In my latest video, podcast episode, and blog post you’ll learn:

- How do homes compare to other growth investments for rate of return?

- Why is it unfortunate for people if their home is their largest investment?

- Why do they call home equity “dead equity”?

- What are the 2 non-investment reasons homeowners tend to be wealthier?

- Why do homes start being a great investment but then stop?

- What are the advantages tenants have over homeowners for wealth building?

- How can you make renting your secret to smart wealth building?

- What are 3 effective strategies to grow wealth faster without owning a home?

Many people feel they are missing out because they cannot afford to buy a home or choose not to buy a home. They may think that owning a home is the cornerstone to building wealth and eventually being financially independent.

However, the good news is that renting could be your secret to smarter wealth building.

Before we get into how to make renting your home a smart wealth building strategy, it’s important to understand how homeowners grow wealth.

How do homes compare to other growth investments for rate of return?

For many people, their home may be their only major investment. For them, that old conventional wisdom might be true. But that is unfortunate.

The average home in Toronto has grown in value by 6.3%/year the last 50 years. This is more than most other cities in Canada.

The central growth investment for long-term investing and retirement investing is the stock market, where returns have been dramatically higher. In fact, Toronto homes have grown in value only slightly more than GICs.

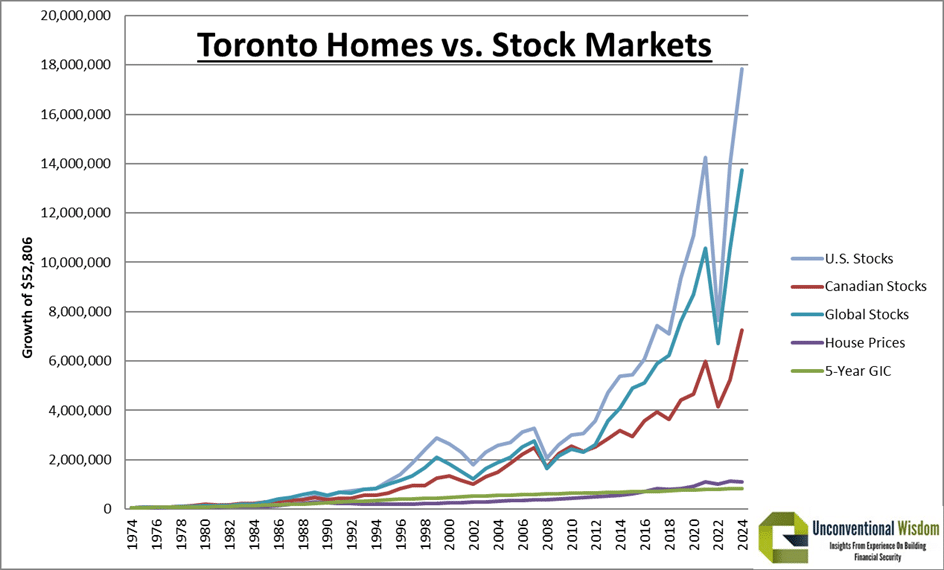

The average home in Toronto on January 1, 1975 was worth $52,806. Investing that amount until the end of 2024 in different investments, here is how much you would have:

Investing $52,806 since 1975

Value end of 2024 Growth vs. Homes

Toronto home $ 1,117,600

GICs (5-year) $ 832,200 0.7 times

Canadian stocks (TSX60) $ 7,242,800 6.8 times

US stocks (S&P500) $17,832,300 16.7 times

Global stocks (MSCI World) $13,727,200 12.8 times

We value our homes for many emotional and non-investment reasons. However, as a pure growth investment, our homes are not high growth.

Remember this stat. The Toronto stock market has had nearly 7 times the growth of Toronto real estate the last 50 years. Global and US stock market returns are much higher.

Why is it unfortunate for people if their home is their largest investment?

If your home is your largest investment, you probably can’t retire comfortably.

Retirement planning has good and bad news. The bad news is that you probably need much more than you think to retire comfortably. The good news is that it can be much easier to get there than you think.

We have written Financial Plans for thousands of Canadians. Everyone is unique. The total investments most need to retire with the lifestyle they want is between $2 million to 5 million. Some with very frugal retirements are less. Some with very comfortable retirements are far more.

You can use the “4% Rule” as a rough estimate. A portfolio of $2 million sounds like a lot, but it supports a retirement of $80,000/year before tax. Think of a couple with each earning $40,000/year. That’s decent, but not comfortable. I know – it’s odd thinking that $2 million is not a lot!

If you are planning to retire in 20 or 30 years, the cost of living doubles about every 25 years. To retire on $80,000/year in 25 years, you will need twice as much, or about $4 million at that time.

Other than some super-frugal people in the FIRE community, financial independence means you become a multi-millionaire.

A multi-millionaire is not rich today!

In short, a home is not a retirement for 2 reasons:

– Home values are usually too small to be a retirement, even if you sell and rent. The average home in Toronto is a bit over $1 million, while most people need $2-5 million in investments to retire comfortably with the lifestyle they want.

– A home does not normally give you monthly retirement income. Homeowners usually keep owning a home after they retire, so their money stays locked in their home. For the purposes of creating a retirement income, a home is “dead equity”.

Why do they call home equity “dead equity”?

What do they mean by “dead equity”? It can mean 2 things:

1. Part of the net worth for homeowners is not getting stock market returns.

2. When they retire, their home equity generally does not give you any monthly cash flow.

The term “dead equity” is exaggerated because it still makes a modest return over time, even if you have no mortgage.

However, the main point is generally true. Owning a home:

1. Does not support your financial freedom and retirement goal nearly as much as it could if you invested similar amounts more effectively.

2. Does not normally give you a regular monthly cash flow once you retire.

What are the 2 non-investment reasons homeowners tend to be wealthier?

Despite the lower returns than other investments, homeowners tend to be wealthier. There are 2 main non-investment reasons for this:

1. Forced savings (discipline): Homeowners are forced to make their mortgage payments, which means they slowly pay down their mortgage. They are forced to grow their equity slowly. Tenants typically have significantly lower monthly payments, but they are not forced to save.

2. Leverage: Homeowners typically start with a down payment of 20% and borrow the other 80%. This means that for a $1 million home, they invested $200,000 but have an asset worth $1 million. They are leveraging 4:1! Their home is worth 5 times the money they invested so their returns start 5 times higher.

Leverage with a 20% down payment means that if your $1 million home grows in value by a moderate 6% or $60,000, you made a return of 30% on the $200,000 you invested.

A 30%/year return is awesome!

If you rent your home, you can use these same 2 principles to grow wealth as fast or faster.

Why do homes start being a great investment but then stop?

One disadvantage that homeowners face is that their home normally stops being a great investment.

Here is the ironic (and funny part). Most homeowners spend their working lives focused on paying off their mortgage. They start with a 20% down payment and are making a return of about 30%. As they pay down their mortgage, their rate of return on the money they have invested goes down dramatically. Once they pay off their mortgage, their home value is growing only 6%.

Mortgage Size Your Rate of Return

80% of home value 30%

60% of home value 15%

50% of home value 12%

25% of home value 8%

Mortgage paid off 6%

In short, a home starts as a great investment with a large mortgage. Then the return drops dramatically as the mortgage is paid down. Once it is paid off, the return is just moderate.

To be a great investment, a home needs a large mortgage!

Tenants do not have to worry about this issue.

What are the advantages tenants have over homeowners for wealth building?

Tenants have several major advantages over homeowners for wealth building.

1. Avoiding “dead equity” in real estate: Tenants are free to invest for higher returns. They don’t have a large part of their wealth tied up in their home.

2. Geographic Mobility: Non-homeowners have freedom to relocate more easily for better job opportunities or areas with lower costs of living without the burden of selling a home or dealing with real estate market fluctuations. This flexibility can lead to higher income or career advancement, which can be invested for wealth growth.

3. Non-homeowners can build wealth as fast or faster using the same 2 non-investment advantages that benefit homeowners.

How can you make renting your secret to smart wealth building?

Here is some good news! If you don’t own a home, you can grow your wealth as fast or faster using the 2 non-investment advantages that benefit homeowners – discipline and leverage.

Here are 3 effective strategies for tenants to grow wealth faster than homeowners:

1. Invest the down payment: A huge savings if you are a tenant is that you don’t need to save a large down payment. But what if you did anyway? It would take discipline to save it and then invest it, but this can be huge for you!

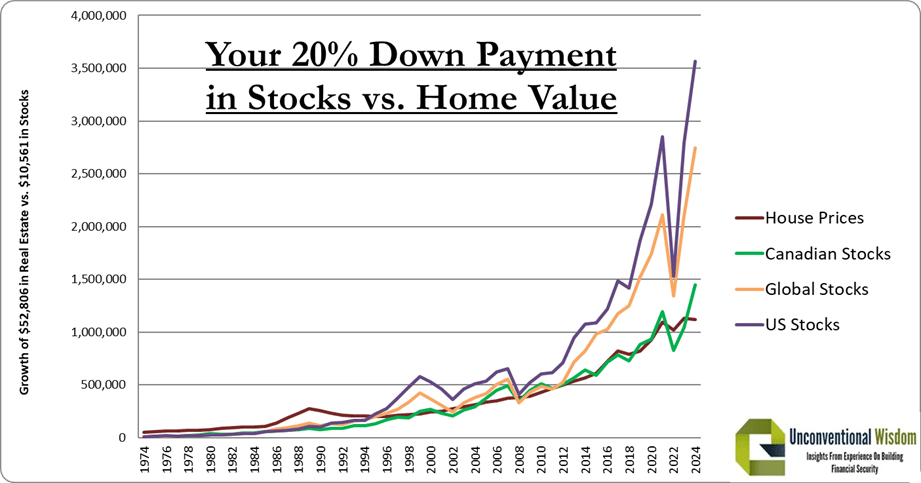

Surprising fact: If you invest just the 20% down payment in stocks, instead of using it to buy a home, it should be worth more than the homeowners’ equity after 30 years. Homeowners pay off their mortgage and their home grows in value for 30 years. However, tenants investing just the 20% down can have more.

Let’s look at the numbers. The average home in Toronto 50 years ago was worth $52,806. Homeowners could have put down 20%, or $10,561, and should have a paid-off home after 30 years. If tenants saved up for a down payment, but then invested it in stocks, they would have had more wealth after 30 years – and a lot more after 50 years.

Investing $52,806 since 1975

Value end of 2024

Toronto home $1,117,600

Investing $10,561 (20% down):

Canadian stocks (TSX60) $1,448,400

US stocks (S&P500) $3,566,500

Global stocks (MSCI World) $2,745,400

Note that investing just the 20% down in global or US stocks the last 50 years is worth about 3 times the full value of the home. In Canadian stocks, it is about 30% more than the home value.

Homeowners tend to pay off their mortgages in 25 or 30 years. This chart starts in 1975, so 25 or 30 years later is 2000 or 2005. Note that all 3 stock markets are well ahead of the home value at both those times, as well.

Remember, this is 20% of the home value invested in stocks compared to 100% of the home value invested in the home!

In short, if tenants have the discipline to just save up the 20% down payment and invest it, they could have a higher net worth than homeowners after 30 years.

1. Invest the lower monthly payments: Tenants tend to have significantly lower monthly payments than homeowners – especially today. It is different with each home, but historically, this has been something like $500/month. Here in Toronto today, we see quite a few people with condos as rental properties. In most cases, the rent is $1,500-$2,000/month lower than the monthly costs, once you include the mortgage, property tax, utilities, condo fees and maintenance.

The average for Toronto condos today is $2,000/month lower monthly payments for tenants.

Typically, rent is a bit lower than just the mortgage payments for both condos and houses in Toronto, but homeowners pay $1,000+/month more for property tax, utilities, condo fees and maintenance.

Investing your savings from lower monthly payments takes discipline, but it can be huge for you!

As a tenant, you can find out or estimate the total costs for your landlord. Note how much higher that is than your rent. Try to save and invest the amount of your lower monthly payments. Or choose an amount like $1,000/month or $2,000/month.

That may sound high, but that is what homeowners are paying now. Investing those amounts for 30 years can be worth more than the home you are renting in 30 years!

Here is what those savings could be worth for you in 30 years (based on the average returns of the last 50 years):

Projected In 30 years

Investment $1,000/month $2,000/month

Canadian stocks $2,318,000 $4,636,000

US stocks $3,721,000 $7,442 000

Global stocks $3,085,000 $6,170,000

Average prices (Toronto) Today

Condo $ 717,200 $4,381,000

All homes $1,117,600 $6,826,000

In short, if tenants have the discipline of homeowners and invest their lower monthly payments, they could have a higher net worth than homeowners after 30 years.

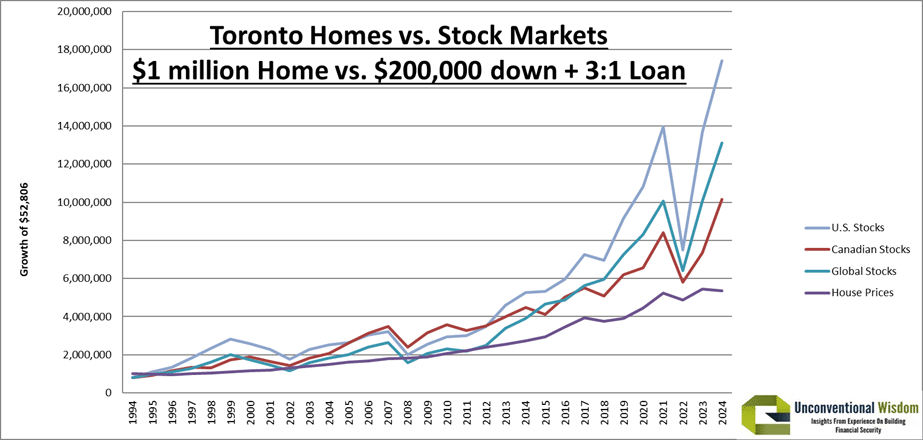

2. Leverage like a homeowner strategy: This strategy is a maximum growth strategy if you have money for a home but choose to rent instead. It combines $200,000 for a down payment and $2,000/month lower monthly payments for renting.

This is an illustration only. Most tenants would not have this much money, but it shows that tenants can make significantly higher returns with a similar strategy and stock market investments.

Homeowners typically start with a down payment of 20% and borrow the other 80%. This means that for a $1 million home, they invested $200,000 but have an asset worth $1 million. They are leveraging 4:1!

What if a tenant did something similar? 4:1 loans are not available, but 3:1 loans are available from multiple sources. A tenant could invest the amount of a down payment, $200,000, get a 3:1 loan of $600,000. Payments could be $2,000/month after tax (6% loan less 30% tax). The loan payment could be covered by the lower rent vs. total monthly payments for a homeowner.

This is essentially a tenant mimicking what homeowners do.

A big advantage for a tenant here is that the investment loan would be tax deductible, while the homeowner’s mortgage is not.

With returns from the last 30 years, if you bought a home in 1994 for $1 million or you did the “leverage like a homeowner strategy” with $200,000 and a 3:1 loan of $600,000 in various stock markets, here is where you could be today. Note this is $1 million in a home vs. only $800,000 invested in stocks.

Value Today

Homeowner $ 5,349,000

Canadian stocks $10,156,000

US stocks $17,434,000

Global stocks $13,099,000

In short, if tenants save up some money and do the “leverage like a homeowner strategy”, they could get a significantly higher return than homeowners. This does not have to be the equivalent of a down payment. Any amount they save can be invested for higher growth than homeowners get.

In addition, their investment loan is tax-deductible, while the homeowner’s mortgage is not.

If you rent your home, you can grow your wealth as fast or faster using the same 2 ideas that benefit homeowners – savings discipline and leverage. Renting could be your secret to smarter wealth building.

Ed

Planning With Ed

Ed Rempel has helped thousands of Canadians become financially secure. He is a fee-for-service financial planner, tax accountant, expert in many tax & investment strategies, and a popular and passionate blogger.

Ed has a unique understanding of how to be successful financially based on extensive real-life experience, having written nearly 1,000 comprehensive personal financial plans.

The “Planning with Ed” experience is about your life, not just money. Your Financial Plan is the GPS for your life.

Get your plan! Become financially secure and free to live the life you want.

It is worth noting that there is no capital gains tax on the sale of the home as your primary residence unlike holding investments in your non-registered account. Changes the calculus quite a bit.